owner draw vs retained earnings

Taxes on owners draw in an LLC. If he has 120000 in owner equity including his original 50000 contribution and earnings from past years.

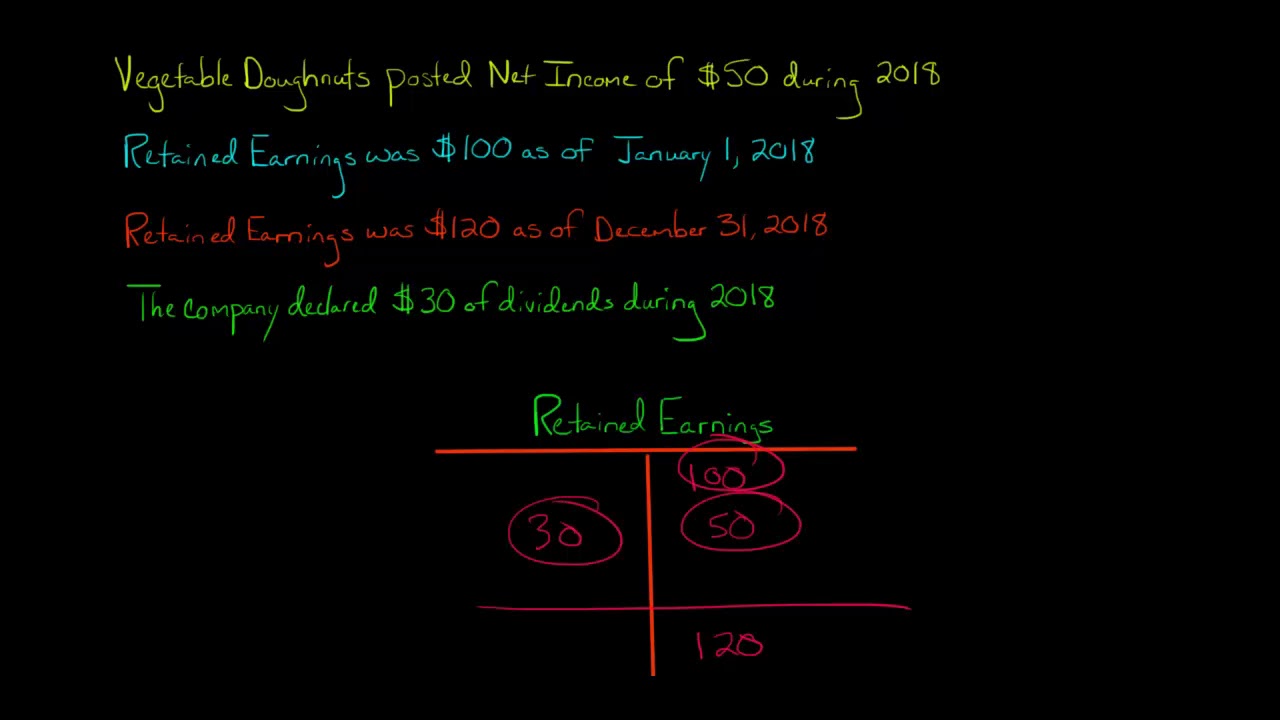

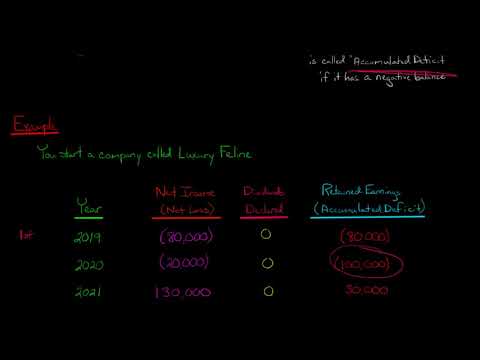

Retained Earnings Example Youtube

The one that does NOT have a Register view no matter what it is named is Retained Earnings or Owner Equity that QB sill close the prior year into.

. Unlike corporations partners pay tax on the partnership earnings regardless of whether they were distributed or retained in the business. When they take a draw for their personal uses they use cash reserves. All other business structures.

This account should be closed out to retained earnings and not carry a balance. However this draw should not exceed the available profit or reserves. Benefits To Being On Payroll.

Owners Draw is money taken out for the Owners personal use. Owners Draw vs Salary. A draw lowers the owners equity in the business.

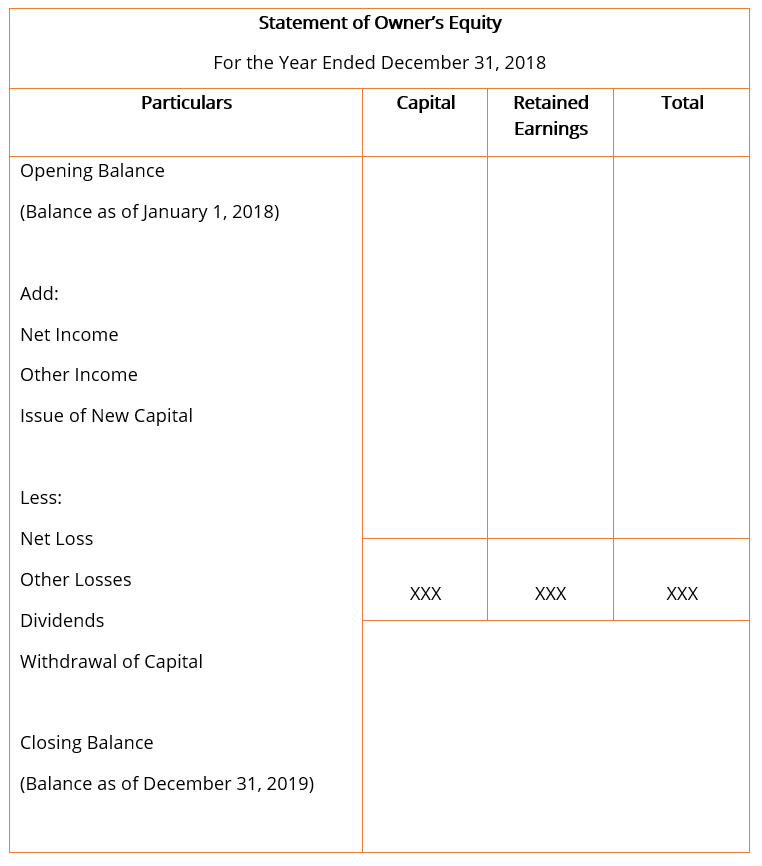

Supedium November 16 2020 Owners Equity vs Retained Earnings. As for Owner Equity open the chart of accounts and try to open each Equity account. The rules governing Limited Liability Companies vary depending on the state so be sure to check your state laws before moving forward.

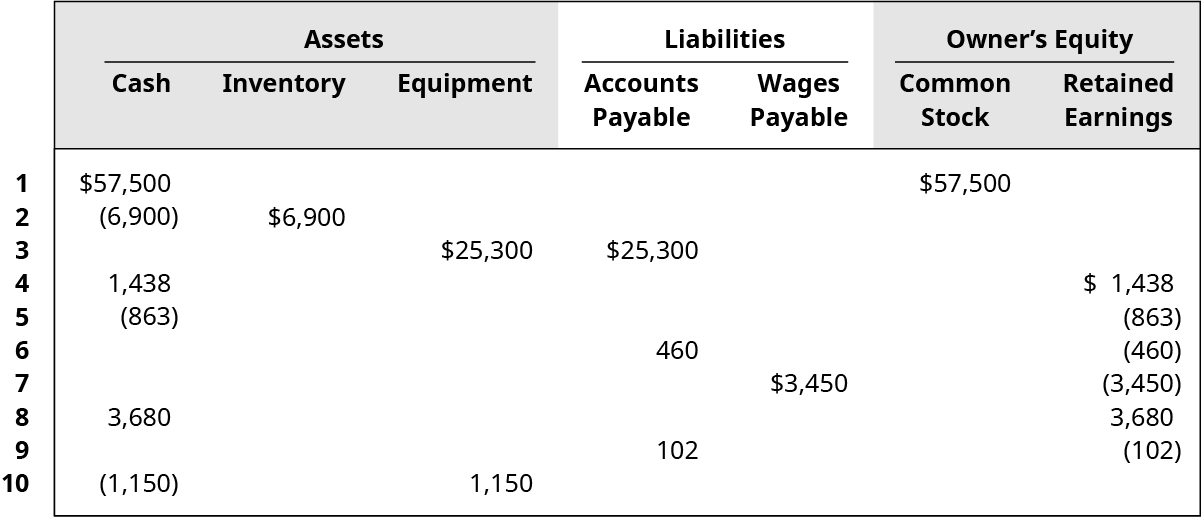

It means owners can draw out of profits or retained earnings of a business. Owners equity represents the business owners share of the company. Posted on March 30 2021 April 1 2022 by Derkia Thomas.

Owners equity is made up of different funds. When you put money in the business you also use an equity account. Instead of a salary the owner pays himself this way.

The owners can retain. Similarly what is owners draw vs owners equity in Quickbooks. The owners loan will be adjusted against dividends or distributions when available.

Retained Earnings is generally profit that gets plowed back into the. If Charlie takes out 100000 worth of an owners draw he runs the risk of not being able to pay employees. Salary decision you need to form your business.

The information contained in this article is not tax or legal. Theres a value to owners equity and its an asset. 4000 in net income at the end of the period.

It comes into play only if the company is a sole propriety or partnership. Owners equity refers to what youve invested in the company whether thats your own personal money or your time. What is an owners draw.

Before you make the owners draw vs. 2000 in dividends paid out during the period. If you pay yourself a salary like any other employee all federal state Social Security and Medicare taxes will be automatically taken out of your paycheck.

Owners Draw Taxes. A Comparison viewed June 21 2022https. Often directors and owners draw more funds than accumulated retained earnings hence the equity.

An owners draw is an amount of money an owner takes out of a business usually by writing a check. Beginning RE of 5000 when the reporting period started. Inside Basis vs Outside Basis.

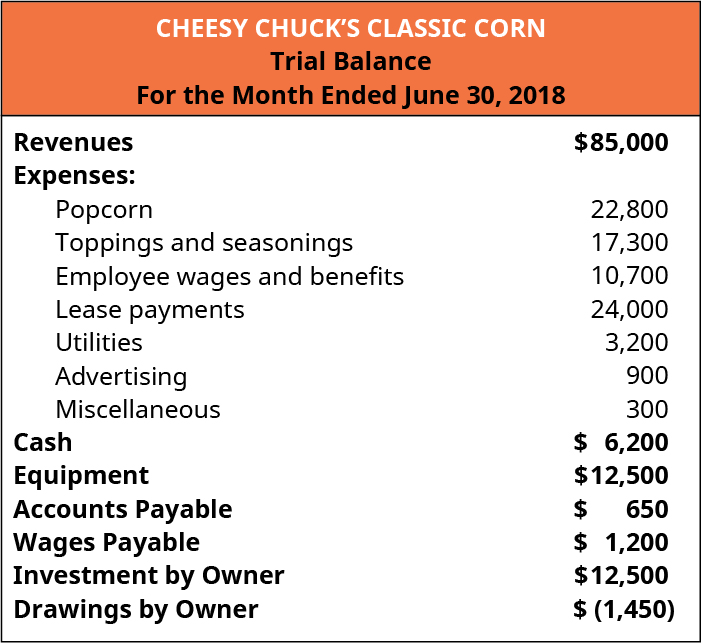

Owners Draw vs Salary Small Business Owners Need Pay Too. In other words earnings are divided and taxed accordingly. To calculate the retained earnings at.

There are two journal entries for owners drawing account. One of the main differences between paying yourself a salary and taking an owners draw is the tax implications. It creates a negative drawings impact on the business.

The business would record such overcompensations as directors or owners loans. The C Corp files a tax return and pays taxes on net income profit. An owner of a C corporation may not.

When you take a draw you essentially are lowering the amount of owners equity. Because your company is paying half of your Social Security and Medicare taxes youll only pay 765. The draw decreases the owners capital record and owners equity so now the equation will be.

You cannot set up Subaccounts here. So your chart of accounts could look like this. In both LLC entities single and multiple the business owner pays taxes from owner draws the same way they would.

Inside basis is the total value of the business. The owner still must keep track of his expenses revenues and net income as well as the money he keeps in the business and uses for equipment transportation postage salaries and other expenses. Owners draws are usually taken from your owners equity account.

An owners draw also called a draw is when a business owner takes funds out of their business for personal use. Although paid differently both concepts present the same idea. Owners Draws 50000 Total Closing Owners Equity.

An owner of a sole proprietorship partnership LLC or S corporation may take an owners draw. The above picture is from data in QuickBooks Online. There are many ways to structure your company and the best way to understand the differences is to consider C Corps vs.

Owners draws can be scheduled at regular intervals or taken only when needed. An owners draw also known as a draw is when the business owner takes money out of the business for personal use. The draw decreases the owners capital record and owners equity so.

Opening Balance Equity This account gets posted to when you create a new chart of account for a loan or item that you enter a opening balance for in the set up of the account in QuickBooks. Business owners might use a draw for compensation versus paying themselves a salary. Of course it fluctuates as your net profits ebb and flow each month.

Owner draw is an equity type account used when you take f Owner draw is an equity type account used when you take funds from the business. A sole proprietor does not keep a separate account for retained earnings since he doesnt pay dividends out to shareholders or partners. Retained earnings is the amount of net profit or loss a company has accumulated since its inception.

Think of inside basis as belonging to the partnership entity as a whole. Owners Equity 400 Assets 1200 Liabilities 800. The WHY you took funds draw.

Accumulated Other Comprehensive Income And Treasury Stock Accountingcoach

Owner S Draw Vs Salary How To Pay Yourself Bench Accounting

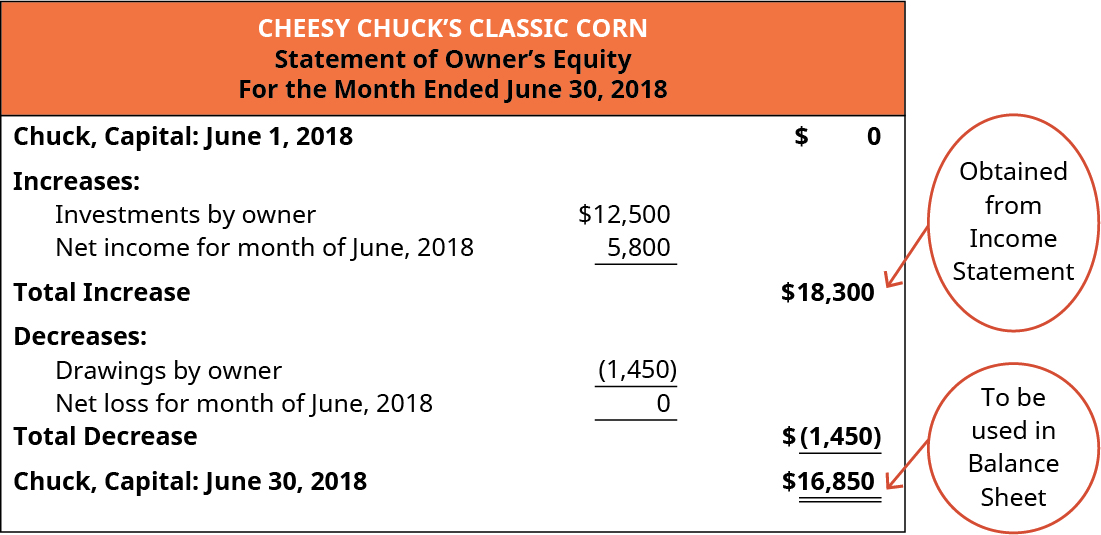

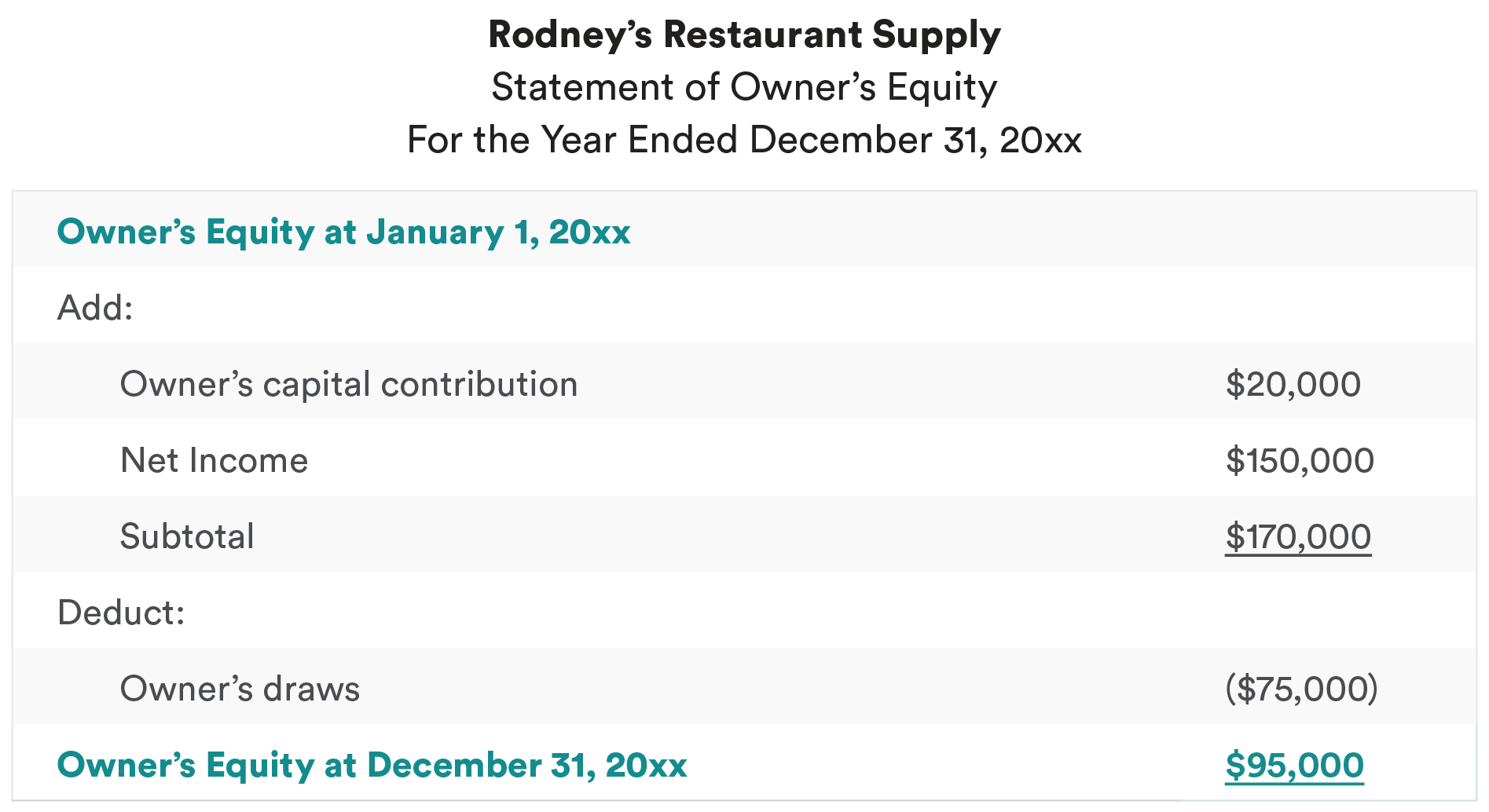

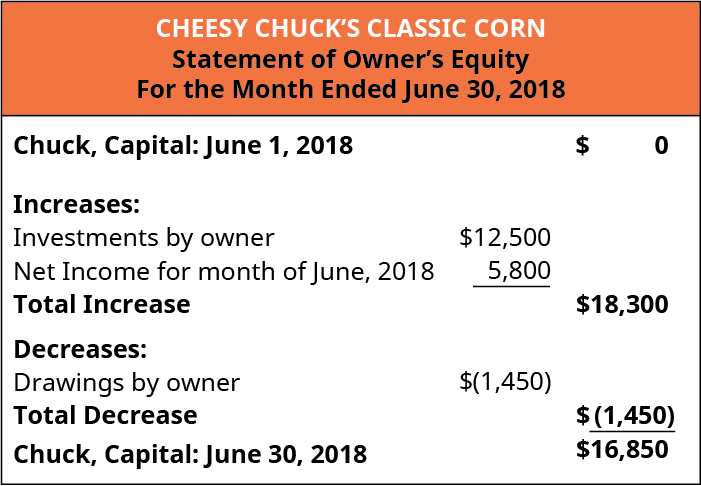

Prepare An Income Statement Statement Of Owner S Equity And Balance Sheet Principles Of Accounting Volume 1 Financial Accounting

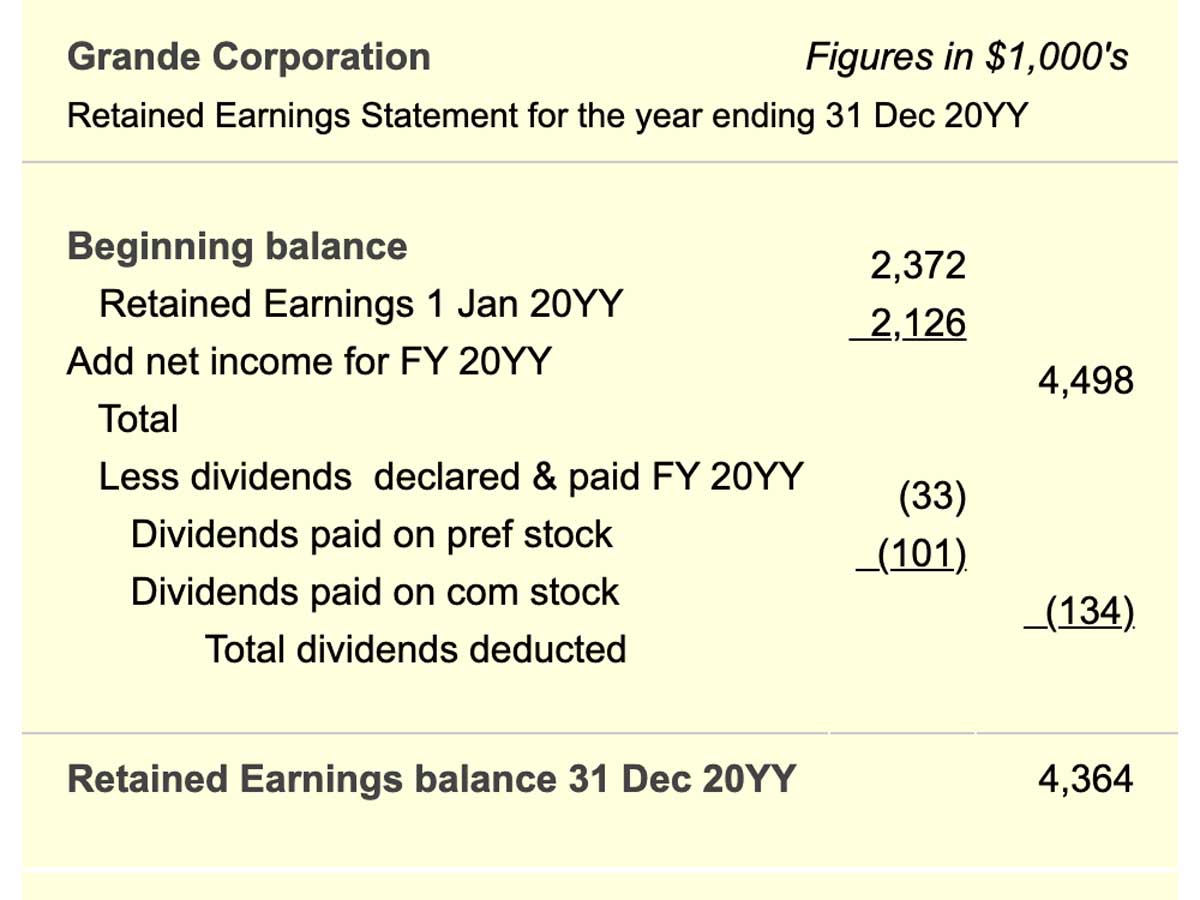

Statement Of Retained Earnings Reveals Distribution Of Earnings Business Questions Earnings Business Case Template

Prepare An Income Statement Statement Of Owner S Equity And Balance Sheet Principles Of Accounting Volume 1 Financial Accounting

Retained Earnings Account Is Missing

:max_bytes(150000):strip_icc()/Clipboard02-5c6ecfab46e0fb0001b6815b.jpg)

Expanded Accounting Equation Definition

The Statement Of Stockholders Equity Youtube

:max_bytes(150000):strip_icc()/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)

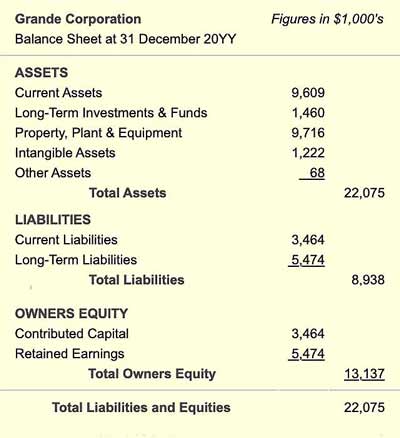

Balance Sheet Definition Formula Examples

Owner S Draws A Complete Guide To Owner Drawings Financetuts

Prepare An Income Statement Statement Of Owner S Equity And Balance Sheet Principles Of Accounting Volume 1 Financial Accounting

Equity Statement Definition Accounting Equation Line Items

Owner S Equity What It Is And How To Calculate It Bench Accounting

Prepare An Income Statement Statement Of Owner S Equity And Balance Sheet Principles Of Accounting Volume 1 Financial Accounting

:max_bytes(150000):strip_icc()/BOA-f8957c5ee9c14788b59a7e5edd802a7b.jpg)

Which Transactions Affect Retained Earnings

Owners Equity Net Worth And Balance Sheet Book Value Explained

Owners Equity Net Worth And Balance Sheet Book Value Explained